Top marginal income tax rate: United States, France, and Japan, 1981... | Download Scientific Diagram

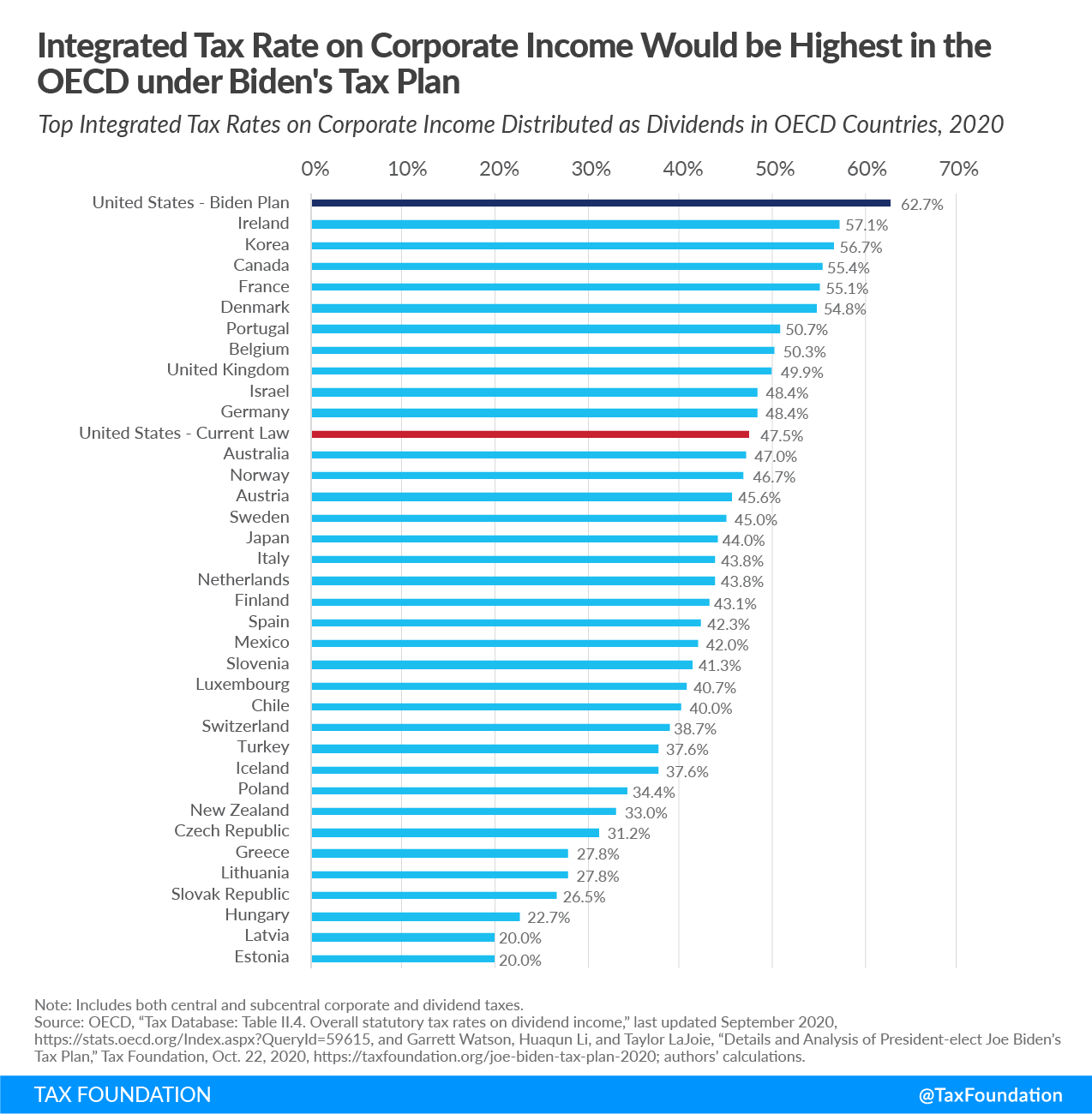

Tax Foundation on Twitter: "President-elect Joe Biden's proposal to increase the corporate tax rate and to tax long-term capital gains and qualified dividends at ordinary income tax rates would increase the top

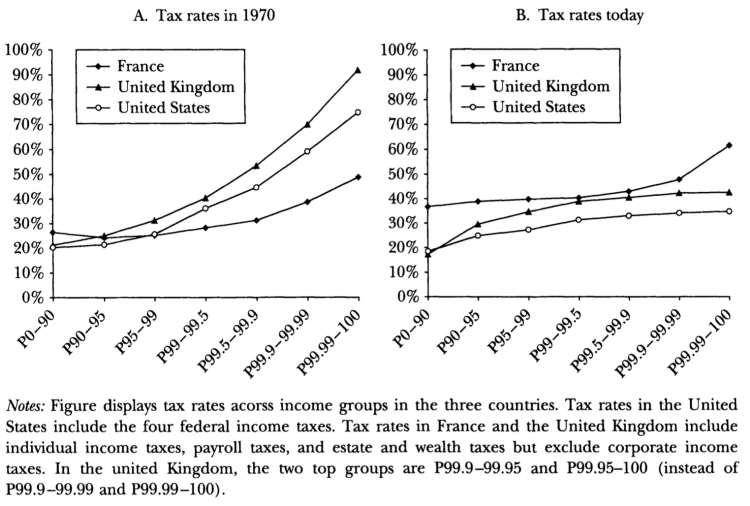

TOP MARGINAL INCOME TAX RATES: BRITAIN, FRANCE, GERMANy, AND THE uNITED... | Download Scientific Diagram

/dotdash_Final_Countries_with_the_Highest_and_Lowest_Corporate_Tax_Rates_Nov_2020-01-671165481d094f6bb0a0c363689bfa67.jpg)